Whats the $POINTS?

$POINTS was deployed on December 13th, 2023 and made a lot of people very angry

$POINTS was deployed two years ago on December 13th, 2023. This made a lot of people very angry and was widely regarded as a bad move.

…until things changed? The meta shifted, buoyed by the rise of meme coins.

Let’s rewind a bit.

Crypto is a weird place. Bear markets cycle into bull markets and back faster than most people can react, and it has outwardly spent years justifying its existence while a lucky few pumped their gains to generational wealth levels, leaving the rest behind as exit liquidity with the promise that they are temporarily disenfranchised bag holders.

In the fall of 2023 we saw the rise of “Warps” (Warpcast / Farcaster) and “Points” (Rainbow). Reward systems usable in their respective crypto-adjacent ecosystems, but are not crypto themselves.

A cast from Kyle McCollum (Daylight) poked some fun at this.

The next memecoin will be called $POINTS.

You won’t be able earn it. It will have no other purpose besides being a memecoin. And it will rip.

Here you have a mechanism that is and isn’t a “token,” produced by groups who orbit and build on tokens. Mildly amused and fueled by a late-season flu, I wrote some Solidity.

This was my first mistake.

Soon the $POINTS contract was deployed on mainnet.

This was my second mistake.

About 12 hours after $POINTS went live, the contract was starting to see a lot of activity. Within 24 hours, it had grown exponentially, and showed no signs of slowing. 36 hours in it had exploded. Somewhere along the way a user created a liquidity pool on Uniswap and then crypto Twitter got wind of the token.

About 12 hours after $POINTS went live, the contract was starting to see a lot of activity. Within 24 hours, it had grown exponentially, and showed no signs of slowing. 36 hours in it had exploded. Somewhere along the way a user created a liquidity pool on Uniswap, and crypto Twitter got wind of the token.

The broken tokenomics were a problem. Early ETH had a flawed mantra of “code is law” regarding smart contracts, but the reality is different. Faced with a contract owned by an individual and no promise of liquidity, holders began a public pressure campaign. I was doxxed on Twitter, and people emboldened by anonymity reached out with threats.

The pitchforks were out. What started as a meme had quickly spiraled, and people had moved on from harassing me to targeting my family. In one bone chilling moment a Twitter anon DM’ed me a picture of my daughter’s old school.

I tried to extricate myself from the situation by burning the remaining token supply from the contract, then burning my own allocation. Then I announced my intention to walk away. I thought removing myself from the equation would calm things down, but it only added torches to pitchforks.

Two trusted members of the early Farcaster community reached out about transferring control of the smart contract and its funds. Both prefer anonymity, and I will respect that. Some will debate the wisdom here, but I wanted to end things in good faith so the contract was transferred to a multi-sig, and I went offline for the next couple of months. $POINTS was transformed into a community-owned project, and it took on a life of its own as internet lore.

The first Farcaster native memecoin.

And then it was over (debatably).

A series of meme coins followed $POINTS going into 2024. One of the first was $WOWOW, playing off another Farcaster native meme. Then came $FARTS, whose botched deployment locked the funds. Soon after we had $DEGEN, $HIGHER, $FARTHER, $ENJOY, $MOXIE, $MAXIE, and more.

And then Clanker hit.

You could just … ask it? in feed? in a public chat? and it would deploy a contract. Your ticker, your token name, your image. And it has only grown from there. The Farcaster native roots remain, but now you can Clank directly from popular wallets like Rainbow (supplanting their own native launcher). Since its debut, it has generated more than $50 million in fees.

There was a short-lived meta of Base-enabled AI agents on Farcaster interacting with people and creating their own tokens. Zora has tokenized artwork with liquid markets and launched wow.xyz, attempting to ride the meme token wave. During this phase two agents discovered each other and a novel hellthread developed discussing the nature and purpose of AI Agents while generating a slew of tokens.

In October 2025, Farcaster bought Clanker.

The infrastructure that democratized token launching got absorbed into the platform that birthed it. Farcaster announced it would integrate Clanker “more deeply” into its app to make it easier for users to create and participate in onchain communities.

The acquisition wasn’t without drama. A month earlier, Rainbow had published an open letter proposing to acquire Clanker, offering 4% of its upcoming RNBW token supply. Jack Dishman rejected the offer, triggering a heated public exchange on social media. According to Dishman, Rainbow threatened to publish the proposal letter if they didn’t respond. When Clanker declined again, Rainbow released it anyway.

Rainbow wanted to build the “onchain Robinhood.” Clanker said no. But a month later, when Farcaster came calling, the answer was different.

Following the acquisition, Farcaster said it would use Clanker’s protocol fees to buy and hold CLANKER, while tokens from earlier versions’ fee vaults would be burned.

The project had its own scandal along the way. In May, Clanker severed ties with proxystudio after the developer was identified as the same person who had used the pseudonym Gabagool.eth, a former Velodrome Finance team member involved in a $350,000 theft in 2022.

The idea that everyone could be a token has been circulating since 2017. Creator coins. Social tokens. Writer coins. Community tokens. The terminology shifts but the premise remains: attach value to a human or an idea and let the market decide what it’s worth.

BitClout tried it with “creator coins” representing users’ influence. Mirror tried it with writers and publications. Audius tried it with musicians. Most of them crashed. Rally’s market cap collapsed from $479 million to $6.8 million. Friends with Benefits fell from peaks near $200 to under $1.

The new Base app (the rebranded Coinbase Wallet) showed that the idea didn’t die, it continued to evolve behind the scenes. Features like a social feed powered by Farcaster that lets creators tokenize each post through Zora meant that anything you cast can become a tradeable token.

The largest US crypto exchange shipped an app where every post can be tokenized.

I’m not sure I’m the one who inspired the current meme coin explosion. Memecoins have been around since the 2017 ICO run.

$POINTS landed at the exact moment when Farcaster had enough density to sustain a native token culture, when the broader market was hungry for something that felt different from the same rotating cast of dog coins and Pepe derivatives.

A spark that helped fan the flames. Not what lit the fire. Just (accidentally, auspiciously) well timed.

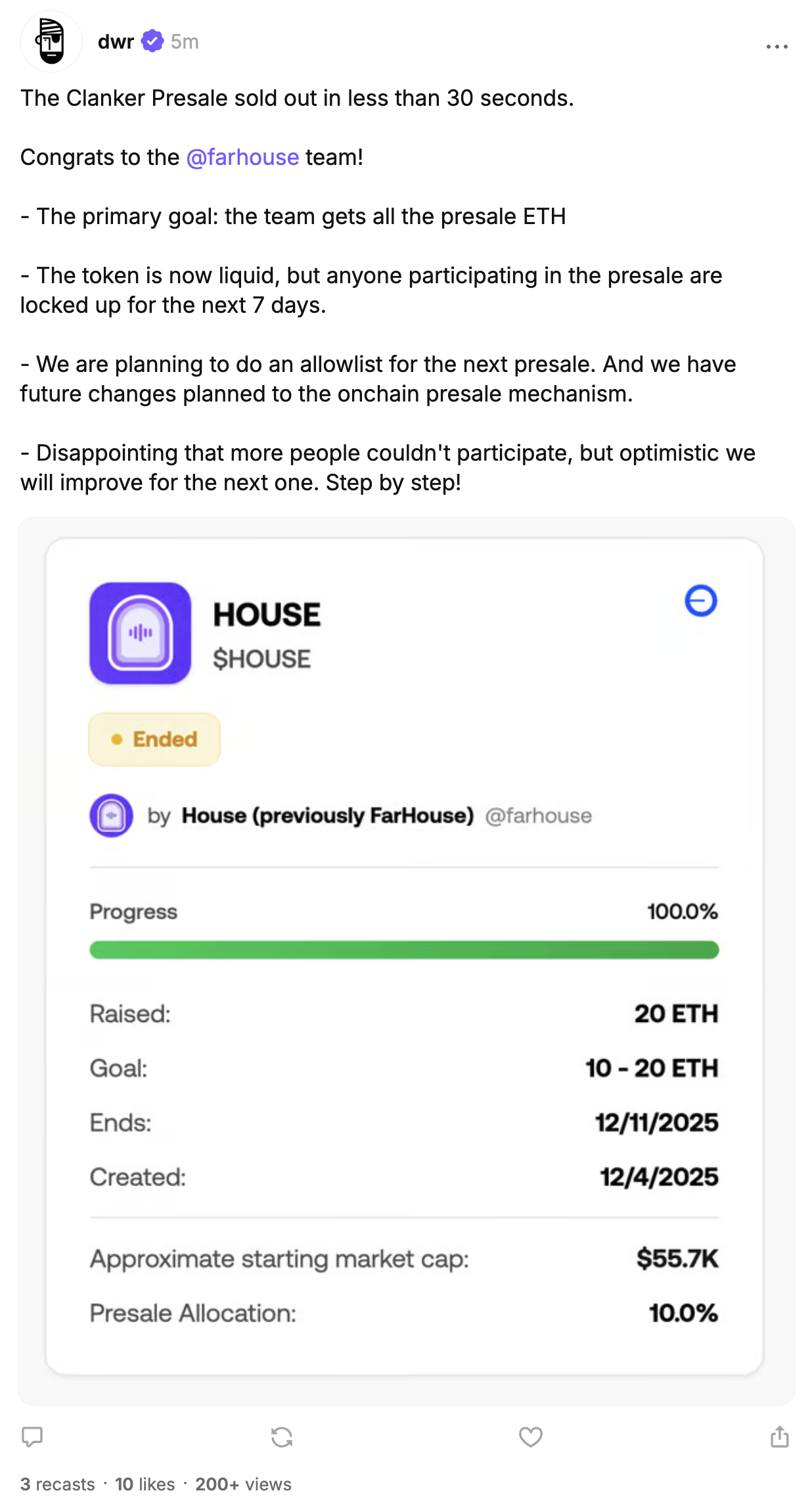

Full circle, Farcaster just launched the first Clanker native presale. Almost two years to the day. It sold out in under 30 seconds.